Written by David Granatstein, WSU TFREC.

Organic food sales in the U.S. grew about 8% in 2016 over the previous year, and many products were in short supply. Domestic production has not kept up with demand, leading to increasing imports. For organic apples, Washington State produces over 90% of the fresh product in the country, according to the USDA. And Washington orchardists are responding to the market signals.

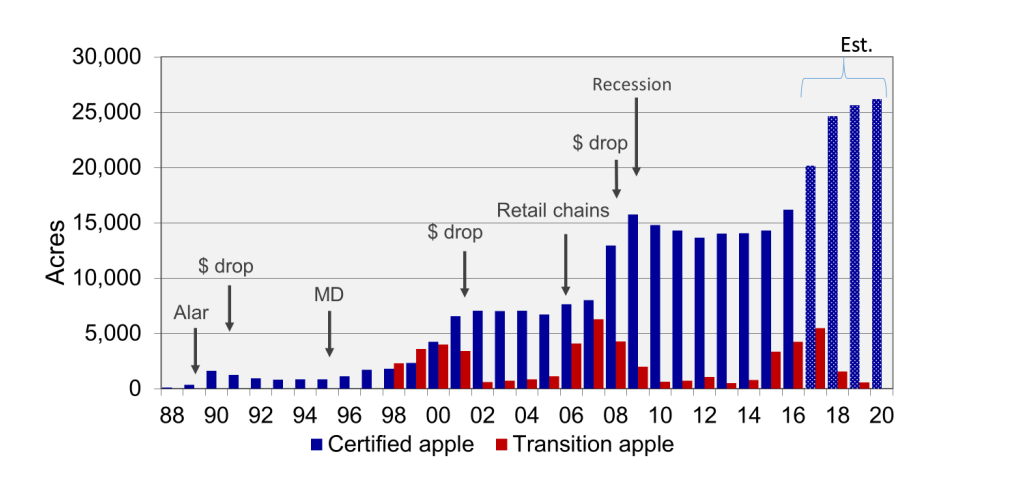

The area of certified organic apples in Washington was relatively flat after a peak in 2009, following several years of rapid expansion before that (Figure 1). The current expansion began in 2015 with 3,300 acres of apples in transition to organic that were registered with a certifier. Growers do not have to register their acres in advance of their application for certification, and thus an accurate tracking of organic apple expansion has been difficult. In 2016, about 2,000 acres of newly certified land came on line, with over 4,000 acres in transition. An industry survey done in January 2017 led to an estimate of 8,500 transition acres in process (to be certified in 2017 or 2018). About half of these acres were not registered with a certifier.

As we approach the 2017 harvest, real-time acreage estimates are being made by WSDA, the main organic certifier in the state, as orchard blocks move through the initial certification process or the renewal process. The January survey suggested that some 4,000 new acres were intended to become certified in 2017, representing a 25% increase from the 2016 harvested area. An acreage report on August 14 suggests that we might exceed that estimate slightly. An additional 5,000 new acres are expected for 2018.

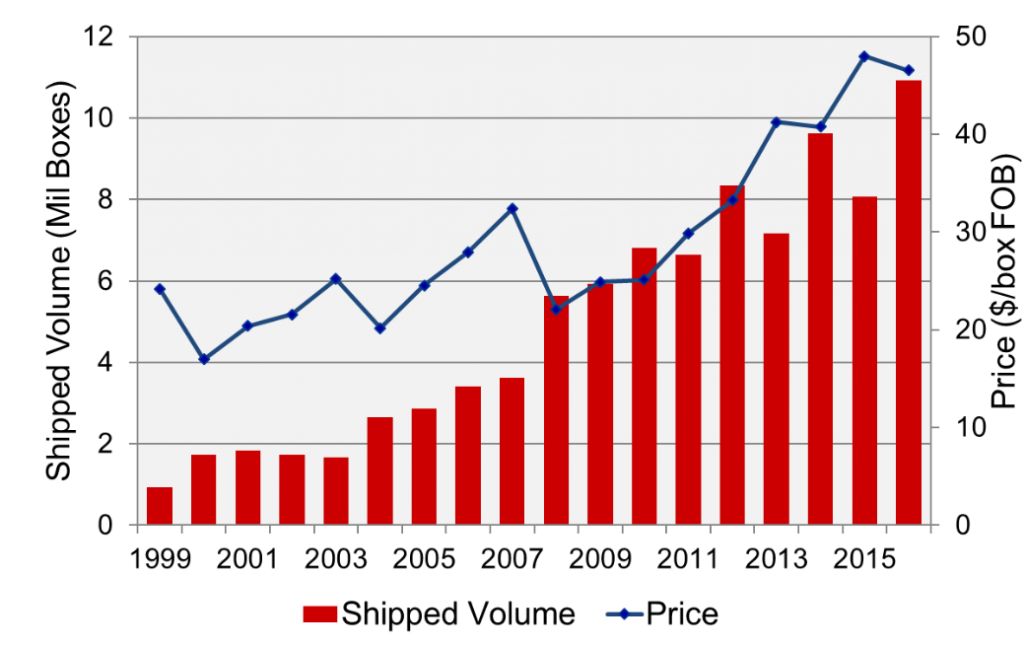

In addition to more acres, average organic apple yields have increased 50% from 2007 to 2015. Much of this is due to new high-density plantings coming into organic production. At the same time, shipments of organic apples from the state illustrate a clear alternate bearing pattern (bars in Figure 2), with even years being the “on” years. With an estimated 10.9 million boxes of organic apples shipped for the 2016 crop, a 25% increase might lead to a projected 13.6 million box crop in 2017. However, if this is adjusted downward by 15% for alternate bearing (based on 2014 to 2015), we may end up closer to 11.5 million boxes, or a 5% increase in volume over 2016. The organic market has been growing closer to 10% per year, thus new demand should absorb this new volume. The situation is different for 2018 when both new acres and an “on” year coincide. In 2014 and 2016, both “on” years, there was downward pressure on price with the higher volume (line in Figure 2).

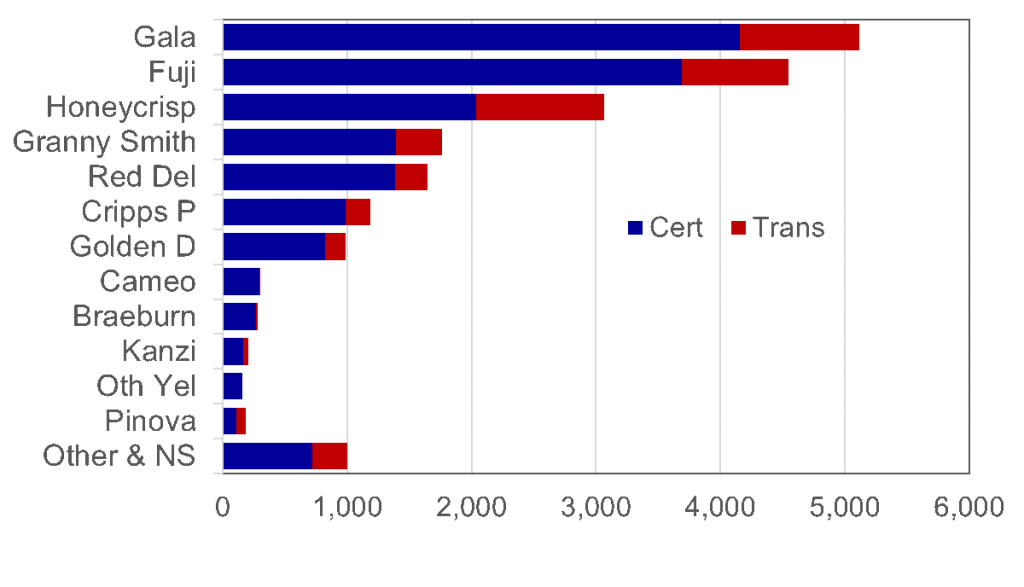

Currently, Gala and Fuji are the dominant organic apple varieties by acres (Figure 3) and volume, with Honeycrisp expanding rapidly in third place. Those three also have the most acres in transition. Demand has also been strong for Cripps Pink and Granny Smith, but declining for Braeburn. Processor markets have also been strong, and some processors need a diversity of varieties beyond Gala and Fuji for blending and other purposes. Pre-sliced fresh apples are a relatively new processing option, and they are overrepresented for organic demand.

More details on the organic tree fruit sector, and organic agriculture more broadly, can be found at http://tfrec.cahnrs.wsu.edu/organicag/organic-statistics/.

Contact

Professor / Sustainable Agriculture Specialist

WSU Extension / Center for Sustaining Agriculture and Natural Resources

Washington State University Tree Fruit Research and Extension Center

Tel. 509.663.8181 x222 Email: granats@wsu.edu